Mar 23, 2024

AI-Powered Report Generator

3 Tips for Making Impactful Financial Reports

In today's data-driven landscape, understanding how to make an impactful financial report is integral. Whether it's articulating revenue growth or detailing accurate statements, the art of financial reporting is essential for both internal monitoring and external communication.

Crafting a finance report transcends mere number crunching; it's about narrating the financial health and journey of your organisation. Recognised as the backbone of financial analysis, a report plays a pivotal role in communicating key data, facilitating accurate financial analysis and decision-making, ensuring adherence to regulations, and streamlining tax processes.

This article aims to guide you through creating impactful finance reports—addressing everything from the right format and structure to the inclusion of key financial metrics and the use of visuals for enhanced clarity.

Understand Your Audience

Identifying and understanding your audience is paramount when crafting a finance report. Tailor your report's content to address the specific interests, questions, and concerns of your intended readers. Consider the following audience categories and focus areas:

Investors: Interested in profitability, growth, and valuation.

Lenders: Focus on liquidity, solvency, and creditworthiness.

Others: Regulators, customers, suppliers, employees, or the general public might have diverse expectations.

Use clear, concise language to ensure your finance report is accessible and engaging. Avoid jargon and technical terms that could confuse or alienate readers. Instead, opt for a straightforward explanation of financial concepts and results. Maintaining a professional tone throughout your report enhances credibility and reflects authority.

Solicit feedback from colleagues or experts to refine and improve your report.

Choose the Right Format and Structure

Choosing the right format and structure for your financial report is crucial to its effectiveness. Here are steps and tools to guide you:

Identify the Type of Report

Your finance report could include balance sheets, cash flow statements, income statements, and shareholder equity statements. Each serves a unique purpose and caters to different aspects of financial health.

Follow a Structured Approach

Make a sales forecast

Create a budget for expenses

Develop a cash flow statement

Estimate net profit

Manage assets and liabilities

Find the breakeven point

Utilise Financial Reporting Tools

There are tools that provide pre-built templates to track essential financial metrics efficiently. These tools simplify the reporting process by organising crucial data in one place.

ALSO READ: From Spreadsheet Chaos to Visual Clarity: The Evolution of Financial Reporting

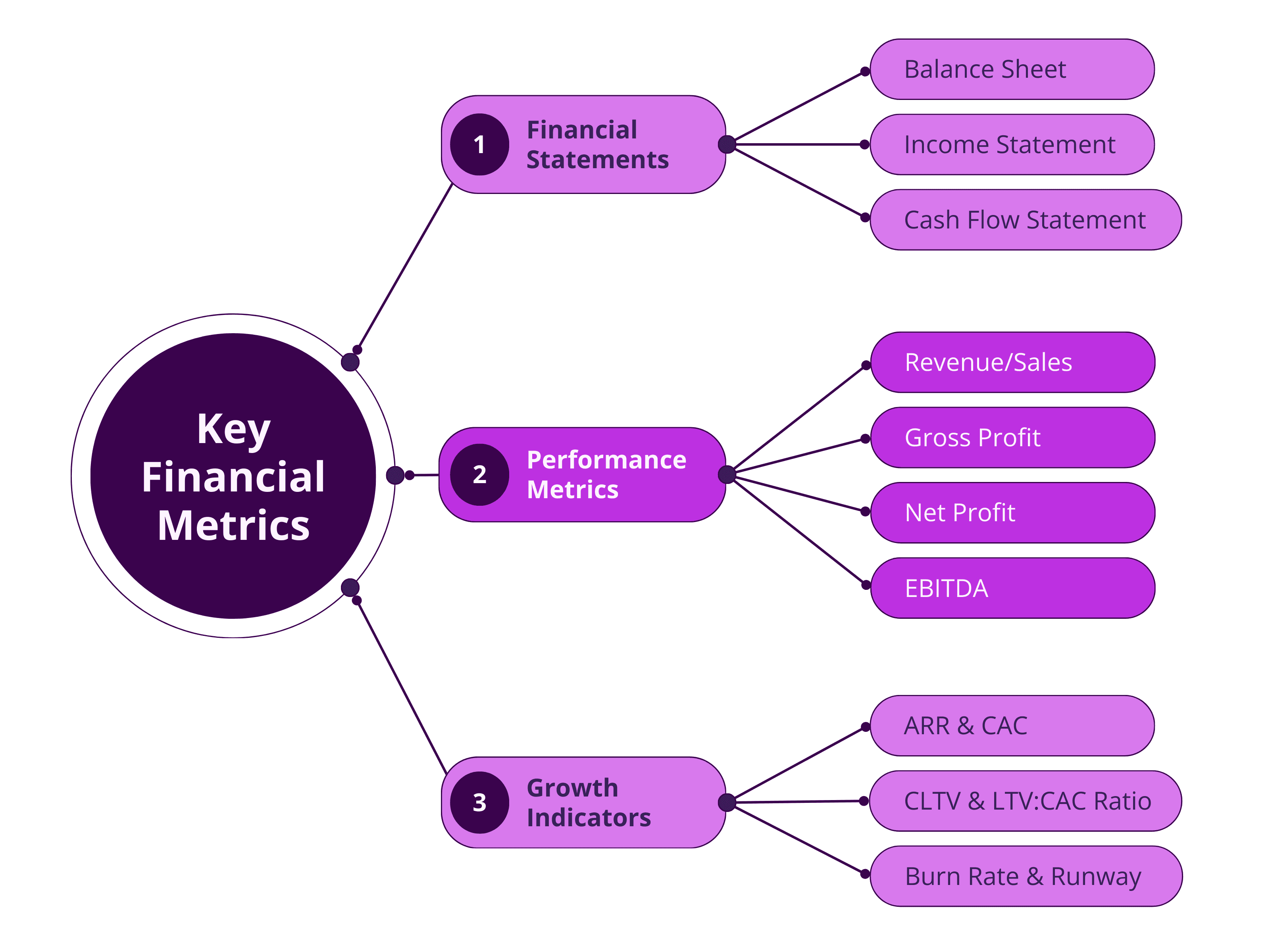

Include Key Financial Metrics

In crafting an impactful finance report, including key financial metrics is essential for a comprehensive analysis. Here's a breakdown of critical metrics to consider.

Incorporating these metrics into your finance report will not only provide a thorough financial overview but also offer valuable insights into the company's operational efficiency and long-term growth prospects.

Utilise Visuals for Enhanced Clarity

Utilising visuals effectively can transform your finance report, making complex data more comprehensible and engaging. Here's how to integrate visuals for enhanced clarity:

Financial Dashboards

Create a central hub for your financial data with dashboards. They provide a visual representation of your company's financial status and performance through easy-to-understand pictures and can be customised to display real-time information or periodic updates, tailored to the specific needs and preferences of each user. This ensures that your finance report is not only current but also relevant to the audience's interests.

Types of Visual Aids

Charts and Graphs: Use these to represent complex data, aiding in quick comprehension and evaluation of financial performance. They are excellent for analysing trends and comparing different data sets.

Tables: Organise and compare data in a structured way, summarising financial information and enabling easy identification of trends and patterns.

Infographics: Combine text and visuals to present complex financial information in an engaging format, making it easier for non-accounting personnel to grasp the essence of the data.

Best Practices for Visual Design

Ensure your visuals are effective by using consistent colours, fonts, and styles throughout the document. Avoid clutter and choose appropriate scales, units, and formats for data presentation. Incorporate annotations and highlights to provide additional information or draw attention to specific data points. Icons and images can also be used to represent concepts or provide background, enhancing the overall understanding of the financial data.

ALSO READ: Streamlining Financial Reporting: How AI Automation Saves Time and Effort

Ensure Accuracy and Compliance

Ensuring the accuracy and compliance of your finance report is non-negotiable. Here are steps and best practices to achieve this:

Adherence to Standards

Follow accounting standards like GAAP or IFRS to ensure your reporting aligns with recognized principles. Regular updates and reviews of accounting policies are essential to stay compliant with evolving standards and regulations.

Regulatory Requirements

Understand and adhere to requirements set by bodies like the SEC, FASB, or other relevant authorities. Implement robust internal controls to prevent inaccuracies and non-compliance, thereby avoiding potential financial penalties or legal consequences.

Continuous Monitoring and Auditing

Engage qualified and independent auditors to verify the accuracy of financial reports and ensure compliance. Establish Key Performance Indicators (KPIs) and conduct regular internal and external audits to monitor reporting performance and improve practices over time.

Remember, inaccurate financial reporting can lead to severe repercussions, including financial penalties or criminal charges. Therefore, it's crucial to establish clear reporting objectives, policies, and procedures, and to utilise the right systems and tools for accurate financial reporting.

Review and Continue Improvement

For a finance report to remain impactful and relevant, it's crucial to incorporate a review and continuous improvement process. This ensures your finance reporting evolves with your business needs and external changes. Here's a streamlined approach:

Monthly Review Steps

Accounts Receivable and Payable: Ensure timely collection and payment processes.

Account Reconciliation: Verify all transactions match bank statements.

Review of Assets and Liabilities: Assess the company's financial position.

Reporting: Compile and analyse financial data for decision-making.

Optimisation Strategies

Create detailed checklists for each financial close process step. Track KPIs such as average days to complete the month-end close and total hours spent on tasks.

Continuous Improvement

Implement DMAIC (Define, Measure, Analyze, Improve, Control) and other methodologies to refine financial reporting processes. Utilise automation and continuous improvement software to standardise processes and reduce errors.

ALSO READ: Efficiency in Reporting: How AI-Powered Tools Are Changing the Game

In Conclusion…

It's important to recognise that the ever-evolving financial landscape necessitates that organisations remain agile, employing the latest tools and methodologies to maintain accuracy, compliance, and relevance in their financial reporting processes.

RyzUp can significantly enable individuals and businesses to craft impactful financial reports that resonate with stakeholders and guide informed decision-making. With valuable insights and practical tips outlined in this guide, preparing insightful financial reports becomes not just a regulatory requirement but a strategic asset for any organisation. To elevate your financial reporting process, consider how tools like RyzUp can enhance your capabilities and effectiveness in this crucial area.